Concur for Travel and Business Expenses

General Guidelines for All Expenses

Students do not have access to Concur. Please see "Student Expenses" for instructions to submit your expenses. Students are still required to follow the expense rules listed here.

1. All reimbursements must be submitted within 120 days of the last expense. If an expense is submitted after 120 days from the date of the last expense, you must provide justification for the delayed submission in Concur. Expenses submitted after 120 days may also be subjected to taxation.

2. Expenses submitted after 1 year cannot be reimbursed.

3. All expenses must have a business purpose explicitly defined. Backup documentation is required for all conferences, workshops, and events. Local expenses must have a business purpose (i.e., Lunch with research collaborator to discuss research).

Training and Getting Started

We recommend that all Concur users sign up for Concur Travel and Expense training in ELM, Columbia's Enterprise Learning Management system.

- Access Concur from the "Log Into Concur" button on the landing page of the Travel and Expense Portal

- Log in with your UNI and password

- Concur requires multi-factor sign-in authentication utilizing DUO

- A log in warning dialog appears, reminding you to review and update your profile settings

- Click OK, and you will be directed to the homepage of Concur

If you have a lab manager who will be processing your reimbursement requests, please assign them as a delegate to your profile using the instructions below. Please note that while a delegate can create and edit your expense, you MUST log in and submit the expense for it to be approved. A delegate cannot submit an expense for review.

- Training Guide: Setting up Your Concur Profile for Expense (Only) Users (pdf) – Use this training guide for everything you need to know about setting up your expense profile.

- Please make sure to select the department code 4041102 NOT 4041104 when setting up your profile.

- Training Guide: Setting up Your Concur Profile for Travel and Expense Users (pdf) – Use this training guide for everything you need to know about setting up your travel and expense profile.

- Assign and Manage Delegates (pdf) – Use this job aid for guidance on the steps involved in assigning delegates in Concur.

Too many emails? Manage your Concur notifications by following these steps: Manage Notification Emails.

If the system prompts you to select an approver, please type in Siddens and select Mary Siddens (mes2314) as the approver.

In Concur, employees can track the status of their expenses as it goes through approval steps. Please view this job aid for instructions on how to track your expense.

Employees: By default, Columbia's reimbursement system will send reimbursements as checks in the mail. The address is updated according to Columbia's PAC System. To update your address or switch to direct deposit, please follow these instructions:

- Log into my.columbia.edu

- Scroll down to the "Self Service box" and click on PAC: View and/or update your HR data to update your address.

- Click on View Your AP Reimbursement Payment Method Information to update your payment information (such as adding direct deposit for reimbursements).

Students: Student address and account information should be updated in SSOL. You should update your US Mailing Address in SSOL to make sure that your payment will be sent to the right address.

If you submitted a reimbursement more than 30 days ago and still have not received any payment, please email Ellie Siddens ([email protected]) with a description of your reimbursement, the amount, and the date that you submitted it.

Chartstrings are detailed accounting numbers which match up with grants or funds owned by a lab, department, or school at Columbia. The finance team in the department will be sharing chartstring information with PIs. Please ask your PI for the correct chartstring for your reimbursement and enter it exactly as they tell you. Using an incorrect code or number for any part of the chartstring can cause the wrong fund to be charged for your expense. You can read more about Chartstrings and the various components here.

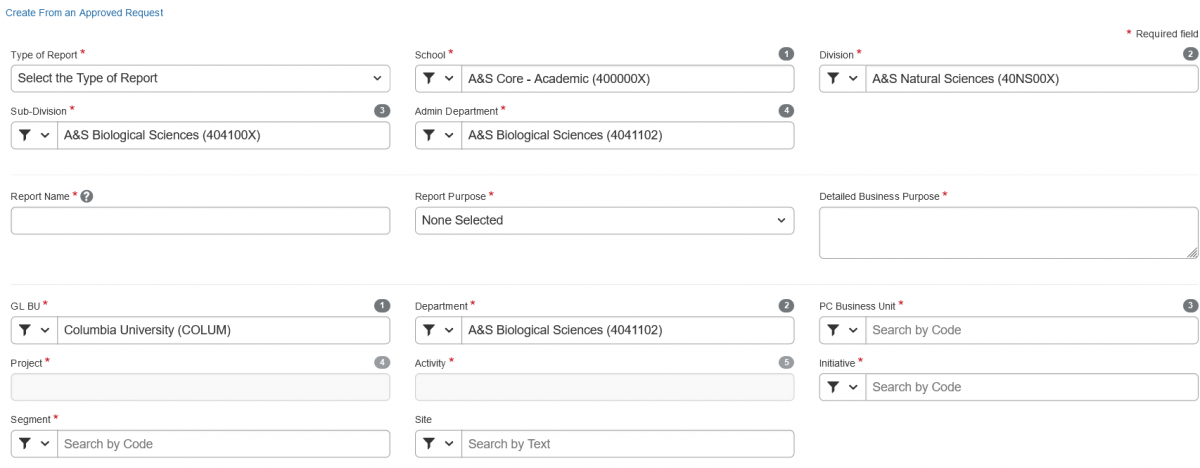

A chartstring consists of the following components:

GL Business Unit: Five letter code indicating which division of Columbia the fund belongs to. Usually COLUM.

Department: a six digit number indicating which department a fund belongs to. Usually 4041102 for the Department of Biological Sciences.

PC BU: a five letter code indicating the type of fund (GENRL for non-sponsored funds or SPONS for sponsored funds

Project Number/ID: Two letters followed by six digits which identify which fund you are using. Usually begins with UR (for unrestricted funds), GG (for government grants), or EN (for endowments)

Initiative: 5 digit code. Another indicator of which fund is being used. Differs based on the fund, but frequently 00000

Segment: up to 8 digits, alpha and/or numeric. For most funds, this code will be the PI's uni.

The first time you submit an expense, you will have to enter more information than the chartstring that will be provided by your PI. This extra information will be saved the next time you submit an expense, speeding up the process significantly! Please enter the information as below:

Student Expenses

All student expenses must follow the same guidelines and policies listed above.

Students (including Graduate Students) do not have access to Concur. Please follow the instructions below for submitting your expenses. Please note that students must still follow Arts & Sciences and Columbia's Travel Expense and Business Expense Policies for submitting reimbursements. You may also refer to this checklist for Concur expenses, in accordance with both Columbia and Arts & Sciences policies.

- Ask permission from your PI BEFORE you make a business purchase. Make sure you know exactly which fund you will be using to pay for this purchase (see chartstrings above). If you plan to be reimbursed on funds from your PI, you must get an email from your PI approving of the expense, the amount, and indicating which chartstring you should use for this expense. (It's okay if the email lists only the project number, rather than that full chartstring, but you will need the full chartstring for number 3).

- Check your address and payment information on my.columbia.edu to make sure it is up-to-date. (See Payment Options above for detail instructions)

- Fill out a Non-Profiled Payee Travel and Business Expense Worksheet. Please note that vendor type on this form refers to YOUR vendor type. As a grad student, you will be either a "student employee" (salary) or "student non-employee" (stipend). If you are unsure about any part of the form, please email [email protected] before making your purchase.

- Email [email protected], receipts for ALL of your expenses, the Non-Profiled Payee Travel and Business Expense Worksheet, and the email from your PI. Each individual receipt should be a separate pdf. Someone from the Business or Academic offices will get back to your within one business day if they have any questions about your expenses. All expenses must have a business purpose explicitly defined. Backup documentation is required for all conferences, workshops, and events. Local expenses must have a business purpose (i.e., Lunch with NIH collaborator to discuss research).

- You will receive a check in the mail or payment via direct deposit, in accordance with how your PAC profile is set up (see Payment Options above). Email [email protected] to check in on the progess of your expense.

Travel Expenses

Please make sure to follow all of Columbia's Travel Guidelines, or your expenses may not be reimbursed. You may also refer to this checklist for Concur expenses, in accordance with both Columbia and Arts & Sciences policies.

Reimbursements for flights & conference registration can be submitted as soon as you make the purchase. Hotels must be submitted after you return from a trip.

Please not that AirBnB is NOT allowed, even if it is the cheapest option. You should look for a hotel in the area of the conference.

You must submit backup documentation in Concur which shows the dates and locations of the conference. This can be a picture of the program, a flier, an email, or a website screenshot.

Please make sure to review the policies when traveling on sponsored funds. If you are unsure of which rules apply your sponsored funds, please email Muin Khan ([email protected]).

Please make sure to follow Columbia's guidelines on International Travel, which you can view here.

Concur has a built in currency converter for foreign currencies (no more Oanda!). Users can specify the currency when they are adding the details of the expense. Once the amount is entered in foreign currency and the currency type is updated, the fields displaying the conversion rate and the amount in USD will automatically appear. The conversion rate automatically updates based on the transaction date. If the bank statement shows the charge in USD, you don't need to convert the foreign currency.

Generally, Columbia allows one business day before the start of a conference/event and one business day after the end of the conference/event for travel. Sometimes, you might choose to arrive a few days early or stay a few days after the conference for personal travel. This is allowed, but you must provide proof that your airfare is comparable with a flight within allowable business days. In Concur, you must specify which days are for personal travel. Hotels cannot be reimbursed for personal travel dates.

Business Expenses

Expenses conducted by employees within the New York Metropolitan area which are directly related to university business are called "business expenses". These expenses can be reimbursed through Concur. Please make sure to review Columbia's Business Expense Policy to make sure your expense can be reimbursed BEFORE making a purchase. If you are still unsure about an expense, please email Muin Khan ([email protected]). You may also refer to this checklist for Concur expenses, in accordance with both Columbia and Arts & Sciences policies.

Please note: purchases made through Ebay and/or Alibaba are not reimbursable. Do not make purchases for your lab through these sites, or you will not be reimbursed.

Please watch this 5-minute video to learn how to create and submit a business expense report in Concur. Alternatively, please see this Expense How Tos page for more information.

For your first expense, you'll need to enter an intial approver before submitting it. Please type in "Siddens" and select Mary Siddens - this is Ellie's first name.

Once submitted, your report will be routed to Ellie Siddens in the 600 office for the initial review. Once Ellie reviews the expense, then Jaya Santosh will approve it on behalf of the department. The expense is then routed to Central Accounts Payable for the last approval step.

Expense Types

Here's is a list of Expense Types in Concur. Expense types in italics should not be used. If you are unsure of which expense type to select, please email [email protected]

- Car Rental

- Car Rental Fuel

- Carpool Reimbursement

- Charter Bus

- Ground Transportation

- Group Booking Deposit/Fee

- Parking

- Personal Car Mileage

- Tolls

- Train/Rail

- Alcoholic Beverages

- Entertainment

- Group Meal

- Individual Meal - Breakfast

- Individual Meal - Lunch

- Individual Meal - Dinner

- Courier/Shipping/Freight

- Minor Equipment - Computers (Do not use this - these purchases must be made through Anthony Gomez)

- Minor Equipment - General (Do not use this - these purchases must be made through the 500 office)

- Office Supplies

- Postage

- Printing/Photocopying

- Publication Costs

- Internet/Online Fees

- Mobile/Cellular Phone

- Telephone/Fax

- Conference/Seminar/Training Fees

- Professional Dues

- Health Fees

- License/Permit Fees

- Meeting and Event Fees

- Passports/Visa Fees

- Event Supplies

- Groceries (Do not use this. Use Individual or group meals)

- Instructional Supplies

- Lab supplies

- Medical supplies - do not use this

- Subscriptions (Newspapers, Magazines, Books, Online)

- Supplies and Materials

- Lease Payments - Vehciles - do not use this

- Rental - Apartment

- Rental - Formal Attire - do not use this

- Rental - General - do not use this

- Advertising

- Continuing Education Costs

- Fleet (Automotive) Expenses

- Fraud/Dispute

- Gifts - Flowers

- Gifts - Non Staff

- Gifts - Staff

- Human Subject Costs

- Insurance - General

- Miscellaneous (do not use this)

- Movement of Household Goods for Relocations

- Personal/Non Reimbursable

- Public Relations

- Repairs/Maintenance

- Services - Audio/Visual

- Services - General (do not use this)

- Services - Photographic

- Tips/Gratuities

- Web Expenses

Receipts

It's a good policy to provide receipts for ALL expenses. Original receipts must be provided for all air, lodging, and rental car expenses. For all other expense types, receipts must be provided if the expense is equal to or in excess of $50.

A receipt may take many forms, including:

- Cash register receipt

- Copy of an order form

- Web receipt or confirmation

A receipt must identify:

- Date of purchase

- Vendor name

- Itemized list and unit price of the purchased items

- Total Amount

To upload receipts to your expense report, you may use:

- Concur Mobile App – take a photo of your receipt and upload it to the App

- Concur Expense – upload a scanned image of your receipt to the Concur web portal

Please note: Original receipts must be kept until the Expense Report has been fully approved, i.e. gone through all the workflow steps and approved by Accounts Payable.

Missing Receipts

If the you are unable to obtain a receipt that contains all the required information, documentation should be submitted to demonstrate as many of the required items as possible. A copy of your credit or debit card statement identifying the date, location and amount of the expense, or a rental agreement, may be submitted along with a description of the purchase, identifying the amount of any expenses to be segregated (i.e., alcohol). You may also submit a missing receipt affidavit in Concur.

Download the Adding a Missing Receipt Declaration to a Concur Expense Item job aid for the procedure.